Lasik and other eye-related procedures are often covered by insurance plans or employer-provided flex-spending programs. Eyesight commonly begins to decline around age 40. Individuals approaching this stage of life should start exploring vision insurance if they do not have it already . It is important to begin the process before the need for intensive vision care arises.

How to Find Vision Insurance

Check with your employer and insurance provider- you may have vision coverage provided by your employer. Checking with them is a beneficial first step to ensure you are not purchasing additional coverage when it is already available. If you have another form of insurance, verify your coverage with them as well.

Contact a broker – if you do not already have coverage, a broker can help you explore your options. Coverage for vision care can vary greatly. You may find the process is simplified by using a professional.

Verify the terms for basic coverage – the majority of vision insurance plans offer coverage for eye exams on an annual basis. Others will provide a set amount for eye glasses (or none at all). If you are only looking for basic coverage, ensure you look closely at these aspects of eye care.

Check for specialized coverage – if you are interested in having coverage for Lasik treatment and other more intensive vision procedures, closely comparing coverage will be necessary. Different plans truly offer a wide range of coverage amounts, with varying deductibles and approved frequency of treatment.

Using Insurance for Eyesight Procedures

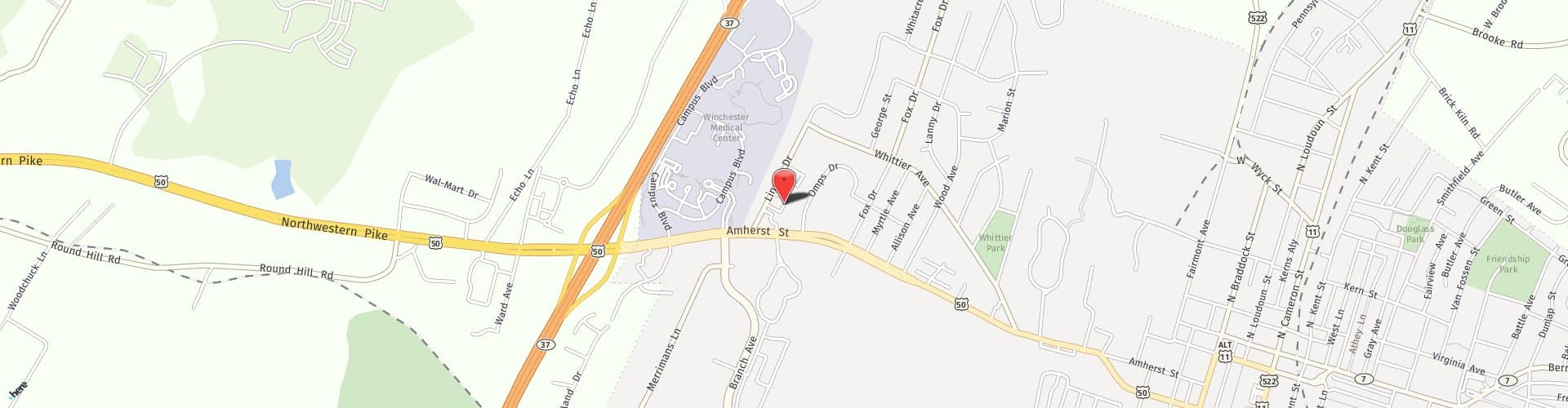

Our practice accepts a number of different insurance policies that cover eligible services. Contact us for more information.

Posted in: LASIK